Why is this happening?

Chip Filson said it best:

This “small credit union” endeavor gave the green light for all credit unions to seek merger opportunities. No matter the size, circumstance, proximity or business logic. It began an open season for self-dealing. CEO’s saw the opportunities to cash out at their retirement; long standing member loyalties were squandered, and a binge of back room deals by leaders of sound local credit unions was officially sanctioned.

Credit unions are disappearing...

Number of US credit unions

We've fallen from a high of 23,866 Federally chartered credit unions in 1970 to only 5,029* in 2021. (And the number is still dropping fast.)

...but we've almost stopped creating new credit unions.

*excludes state chartered, privately insured credit unions.

Number of new US credit unions chartered

In the 1950s, 6,933 new credit unions were chartered. In 2010-2019, only 21 new credit unions were chartered.

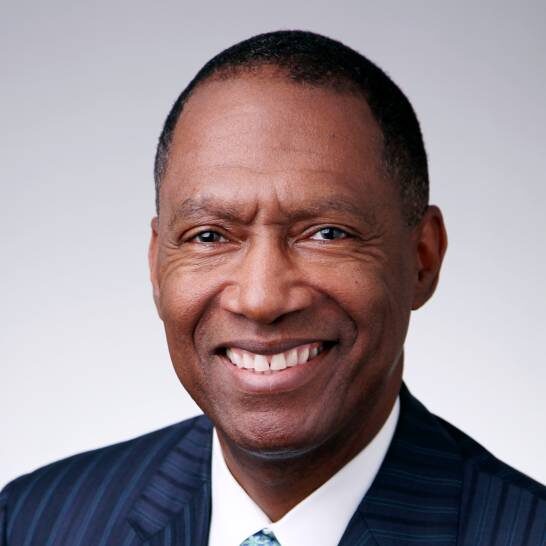

"I firmly believe the interest in de novo credit unions is a signal from communities that they still find cooperative credit matters where their voices play an important role."

Maurice R. Smith, CEO, Local Government Federal Credit Union